When Nintendo dropped the world preview of the Nintendo Switch yesterday, fans went crazy. Twitter went mad about the Switch, while fans took to DeviantART and Tumblr to post parody images — both in good faith and otherwise — about the new console/handheld hybrid. Unfortunately, Nintendo’s shares did not match this rise in spirits, instead dropping just over 6.5% overnight.

Sure, a drop in anything’s price sounds like a bad thing. But don’t freak out! This isn’t necessarily a bad thing. If anything it’s great news!

Understanding the Situation

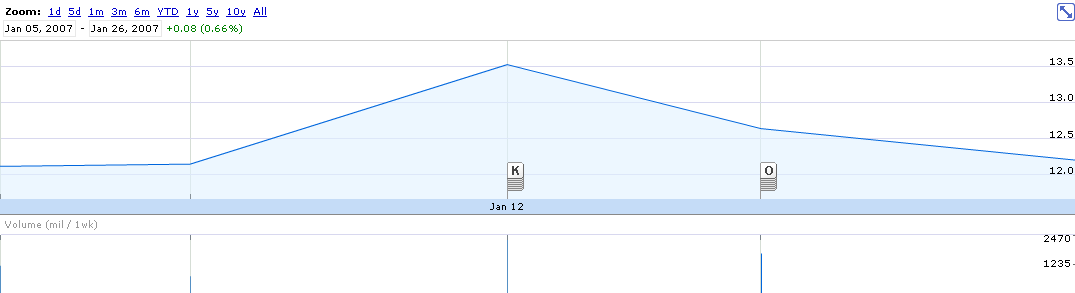

Take a look at the graph above. From the start of October 20th to the time this article was written we see the aforementioned 6.5% drop in Nintendo’s share price. Looks pretty bad, right? Well it isn’t. Take a look at the graph below:

Over the course of this year, Nintendo’s shares had actually gone up by over 50% since July 2016. In reality, the 6.5% drop is microscopic in scale – negligible even. But nevertheless investors, fans, and others have been making a big deal about this drop as if it has already spelled doom for the Nintendo Switch before its rise even began. But this simply isn’t the case.

So what’s actually going on?

There’s multiple reasons as to why Nintendo’s share suddenly dropped. Considering the success of the Switch’s announcement among fans it seems hard to believe that Nintendo dropped the ball. As such, a drop due to a failed announcement is not in the cards. So then what caused the drop?

Reason #1: Simple Wall-Street Money Making

The most common one is the typical rise and fall in share prices that we typically see whenever any company announces a major new product.

For example, in the above graph we see Apple’s share prices before and after the announcement of the first generation of iPhone back in 2007. What’s clearly visible here is that the share prices increase just before and after the announcement of the iPhone 6. However, they immediately start declining from that point onward. The graph — if scrolled right — continues to see a downward trend until it stabilizes down the line.

The reason I bring this up is because the price of shares fluctuate wildly just before and after any company’s big announcement. There’s a saying among stockholders that one should always buy the rumors, but then sell the news. Essentially: when a company is rumored to have a big announcement, shares should be bought. Once the news breaks, sell the shares to make the biggest profit.

This is actually really common in the world of buying and selling shares, and so it should come to no surprise to any experienced shareholder that the prices would fluctuate. After all, who wouldn’t want to cash in on a spike in share prices?

Reason #2: Fears Over Cartridges

Anyone who has worked in retail knows that customers can be absolutely convinced they need to buy something, even if they don’t know what it is. Try as you might to convince them to buy something better, they won’t. Often times it’s because they have heard bad things about it, and as such they don’t want it.

The same can be said of share and stockholders.

Looking at the Nintendo Switch, it’s been overwhelmingly well received. However, many investors are stuck on why Nintendo is returning to cartridges. It may sound absurd to those of us who know a thing or two about cartridge media’s advancements in the last two decades, but to older investors who still believe that a cartridge holds no more than 2 GB maximum this undoubtedly sounds like a nightmare.

Now, I’m not going to start another list of why cartridges are better than disks. However, I will say that it is likely a contributing factor for why Nintendo’s share prices dropped. This is, as I said, a result of ignorance and a lack of information on the system. After all, this was only a preview teaser trailer. Nothing was said about the system’s specifications other than how it visibly functions.

Furthermore, I don’t expect many investors or shareholders to know how many gigabytes a Nintendo Slide cartridge can hold based on how big we already know The Elder Scrolls V: Skyrim – Special Edition is (that’s 22.75 Gigabytes for any investors reading this, by the way). Nor do I expect them to understand how much faster the Nintendo Slide will load up areas in the game as a result of running on the cartridge. Maybe I am giving them less credit than is due, but let’s face it — many of you probably didn’t know how big Skyrim: Special Edition takes up on Xbox One or PlayStation 4 either.

Reason #3: The Drop is Fear Mongering More Than Anything

Reading through the Financial Times piece that discusses the 6.5% drop in share prices, one thing became considerably clear to me. Many of the concerns that were brought up were nothing more than speculation. As with the lack of knowledge about cartridge capacity, the article states that analysts are concerned about: the machine’s price, competing with other consoles, whether it would require a mobile carrier to function, and more.

And this is where I, as a gaming journalist, truly get to laugh at economists for just a little while, and here’s why…

1. The Price of Fear is Always Higher Than It Is Worth

While I would agree that the Nintendo Switch would have to sell for around $299 USD to be successful right now, I can’t imagine that it won’t. After all, Nintendo has never been known for being on the higher end of the pricing scale.

As it stands, the Nintendo New 3DS sells for about $200 USD. Meanwhile, the Nintendo Wii U sells for about $299 USD. Before either of these devices, the Nintendo Wii – considered to be the weakest performing system despite sales – sold for $249 USD (which would amount to about $325 USD after inflation).

Based on this pattern, I would find it hard to believe that the Nintendo Switch would sell for much more than $350 USD at the most. Considering it is a hybrid console, it wouldn’t surprise me at all if it reached up to $400 USD for certain bundles and still gaining favor from potential buyers.

2. Competition is no Issue

When it comes to the war between consoles, Nintendo is already “losing” as far as anyone is concerned. Nevertheless, Nintendo titles have been going quite strong in terms of install rates for their first-party titles, with first-part software having some of the highest attachment rates per-console out there.

As TIME’s Matt Peckham said two years ago, Nintendo doesn’t need third party sales to drive its console sales. The first-party titles are what truly sell their hardware. While third-party support would certainly help Nintendo boost its profits, it isn’t necessarily a requirement.

Even then, third-party support for the Nintendo Switch has been nothing but positive. If the switch is proven to have comparable performance to the Xbox One and PlayStation 4 — even while in portable mode — then it has the potential to destroy its competition. Doubly so if they maintain their cost-free online gaming policy. For these reasons and more, competition should not be a concern for investors.

3. Mobile Carrier Requirements

This one once again reaffirms my position that investors have no idea what they are talking about. The Nintendo Switch’s preview had no hints whatsoever that mobile carriers would be involved in any way. None of the games presented required the internet to play, and the games were all played using the very same game installation cartridges they all seem to be worried about!

This concern tells me that the investors — despite clear indication in the trailer that the console uses cartridges — do not understand that video games don’t need mobile data to work!

Honestly, I blame mobile games for this more than anything else. You would have to have no experience with a GameBoy or DS handheld to make this misjudgement…

Conclusion

Fans, investors, shareholders, and other persons of anxiety need to seriously calm down. Shares dropped by 6.5% after a large spike. They’re about the same as they used to be, and they won’t at all affect how well the console actually sells. Remember, the price of shares are heavily affected by how many people currently own them, and the forecast of the company – which is based purely on speculation.

In the end, there’s no use in worrying about Nintendo’s share prices. Consumers will enjoy — or not enjoy — the Switch console regardless of where the share prices sit at. However, if it does affect your ability to enjoy the console, you have my deepest condolences.